The Federal Revenue Service is expected to publish rules tightening controls over virtual currency transactions in the coming days, after the central bank publishes general regulations in this area. The initial aim is to align Brazil’s rules with Organization for Economic Co-operation and Development (OECD) standards to enable the exchange of information with other countries and strengthen the fight against money laundering and organized crime. Tax decisions are also carefully considered and should not be announced in the short term.

This Monday, British Columbia announced general regulations for crypto assets. This has been anticipated since the industry’s legal framework was approved in 2022, and is due to come into force on February 2nd. The standards created will allow cryptoactive companies to enter BC’s regulated market.

Companies operating in the market or interested in operating in the market must apply for an operating permit from the authorities. In addition, companies established abroad will have to transfer their operations and customers to Brazilian service providers, such as companies in sectors in which they already operate, companies established to operate in this market, and even securities and foreign exchange brokers. Domestic companies are also required to appoint at least three directors.

BC has also established that some activities of virtual asset service providers are treated as exchange operations. This is the case, for example, with stablecoins, which are cryptocurrencies that tend to track the value of a reference asset such as the dollar or euro and be more stable.

International payments or remittances using cryptoassets and remittances of cryptoassets to fulfill obligations arising from the international use of cards or other electronic payment instruments also qualify as foreign exchange transactions.

In the opinion of the national tax authorities, the existing requirement for virtual currency active platforms to provide tax authorities with information about transactions taking place within the country is not met by some companies in this sector, especially those that are not registered in the country. Of particular concern is overseas remittances. It is generally understood that revenue issues in this process may be a sign of money laundering.

The new rules should close these loopholes and make the necessary adjustments to comply with the agreement with the OECD within the Crypto-Asset Reporting Framework (CARF), a framework for providing information on crypto-assets that allows for the automatic exchange of standardized data between participating countries. Brazil will start sharing information next year.

Given the multinational nature of the market, this mechanism is considered important to combat tax evasion and prevent money laundering. For example, CARF stipulates that service providers in this sector must collect and report details of users conducting relevant transactions to local tax authorities.

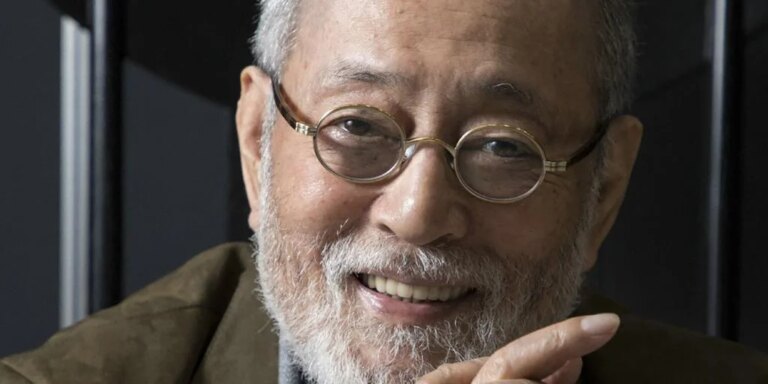

The tax authorities’ intention to tighten controls over virtual currency transactions was announced to GLOBO by Revenue Secretary Robinson Barreirinhas in an interview last week. At the time, Barreirinhas said this was the organization’s next effort to “close the door” on the financial system to organized crime, facilitating the financial suffocation of factions.

He also said B.C.’s market definition could have tax implications for tax authorities, but he said this part is still under consideration within B.C.

—For example, if it is considered a foreign exchange transaction by a regulator, which is BC, it will have IOF (financial operations tax) tax consequences,” Barreirinhas said in an interview.

After the announcement of the BC rules, the market is concerned about the occurrence of IOF in stablecoin operations. Since the tax increase in May, Brazilians are increasingly using these assets for remittances and purchases abroad, as there is currently no IOF tax on this activity.

The new regulatory framework could mean a change in this tax understanding by classifying this transaction as a foreign exchange transaction. However, this depends on the specific actions of the tax authorities.

However, tax experts say that an IOF is likely to occur in the future, especially since the basis for May’s tax increase was the standardization of collections for exactly the same purpose. For example, this is the definition of a 3.5% interest rate on international transactions, international transfers, and cash purchases using credit and debit cards.