The Brazilian Association of Retirees (AAB), one of the groups investigated in what became known as the INSS spree, is headed by the driver, Dozival José dos Santos. The man signed a cooperation agreement between AAB and INSS in 2023 and was subpoenaed to testify before the INSS Joint Parliamentary Inquiry Committee (CPMI) investigating the misconduct.

In the process of big city Dogivar had access, but in 2017 he requested from the National Institute of Social Security itself the right to compulsory retirement after suffering a “herniated disc.” In the action, the man states that he was “a driver and always worked with his hands.” In addition to being “older,” he also declared that he only had a “secondary degree.”

The benefit was awarded to the organization’s president, who is currently filing a separate lawsuit against INSS to update the value of the current retirement benefit.

Mr. Dogival’s case is being processed in federal court, but his name is listed in the INSS CPMI. Adding to this call, on November 6, members of the House of Representatives and the Senate called for the annulment of the banking and tax secrecy of the man, who is also a member of the Brazilian Association of Retired Persons, and his wife.

Please also read

-

federal district

DF church owners are partners of NGOs involved in INSS scam

-

federal district

Convicted of child death in connection with NGO investigated over INSS fraud

-

federal district

Members of the NGO that defrauded INSS have businesses at the same address

-

federal district

NGO investigates INSS fraud, points to church as store headquarters

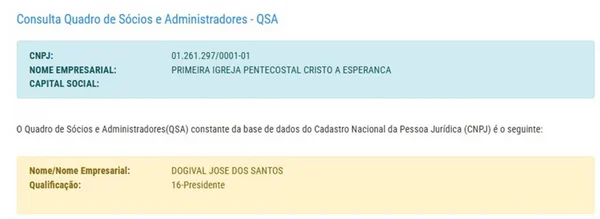

In addition to AAB, Dogival also presides over a church. According to the report, he was identified as the founder of the National Evangelization Crusade (registered with S instead of Z), which operates under the business name “First Pentecostal Church of Christ of Hope.” According to data Dogival provided to the IRS, the religious institution operates in Ceilândia.

2 images Close the modal.

Close the modal. 1/22/2reproduction

1/22/2reproduction

The second person connected to the Brazilian Association of Retired Persons is Lucineide dos Santos Oliveira, president of the evangelical Pentecostal church Ministerio Visan de Deus in Lecanto das Emas, about 20 miles from the Brazilian capital.

The Lucineide name also includes at least five companies within the same administrative area. They are Impacto, R & D Security, Solution Serviços de Locação, Expresso Serviços de Publicidade and Prospera Produtos. These ventures offer everything from retail to car rental to agricultural support activities.

Curiously, CNPJ under the name Lucinaide has the same address as a company belonging to Samuel Crisostomo de Bonfim Jr., an accountant for the National Confederation of Farmers, Families and Entrepreneurs (Conafer), another agency involved in the INSS fraud. In fact, one of Samuel’s companies is said to operate in the same location as the church Lucinides founded.

The big city When he went there, all he found was a religious building built between the catechism center and a vacant lot. Nevertheless, according to Federal Revenue Service data, Samuel’s stores are active in this field, raising suspicions that they are shell companies.

A third party connected to Conafar, identified as Cicero Marcelino de Souza Santos, also operates a company at the same address as Lucinaide and Samuel’s business. According to documents released by the Federal Revenue Service, the projects in question, Nobre Eventos e Cunha and Santos Locações, lack signs on the facades of the buildings where they are supposed to be located.

Cicero, who told CPMI that he made “a few dollars” from the money that was supposed to go to INSS beneficiaries, is an advisor to Conafar president Carlos Roberto Ferreira López.

In his testimony on October 16, Mr. Cicero admitted that he created a company to provide services at the request of Mr. Carlos Lopez. He denied knowing Samuel Crisostomo and also said he had received payment slips from the Conafar entity and handed them over.

Mr. Santos also denied knowing where the resources Conafer received came from. However, he and his wife would have transferred R$300 million from the institution since 2019.

During CPMI, Cicero’s company was recognized as an Orange Company. “The only thing I see in this CPMI is that the union is supporting the managers themselves and their families, the managers’ companies and their families, or the orange people and their families. And you are an orange person and your company is an orange company,” said Adriana Ventura, vice president of Novo-SP.

pension system

Conafer publishes the +Previdência Brasil program on the federation’s website. According to the page, the program aims to promote social security education and information about INSS Digital. The initiative also includes a course on benefits to help stakeholders advocate for their rights.

The website also details that there is no cost to this process. “Associates will not receive compensation from INSS or Users for performing their services and will not be precluded from charging beneficiaries of their services the association’s monthly fees,” the portal states.

However, CGU’s investigation showed that the situation was not as it appeared to Mr. Conafer. Auditors interviewed 56 people from 16 divisions of the federation who had received discounts from the federation. None of the victims authorized the transfer.

The administrator added that in the first quarter of 2024 alone, 621,094 retirees received discounts on Conafer-related payments.

AAB asked for discounts for deceased persons

The Brazilian Association of Retired Persons requested a discount for the benefit of people who have been dead for decades. An investigation conducted by the Federal Comptroller General (CGU) found that the Brasilia-based AAB improperly required the inclusion of association discounts for deaths in more than 27,000 cases.

This is the case, for example, of Jaime dos Santos, who died on October 25, 2002 at the age of 46. Still, the organization asked him to join the INSS discount list in March 2024, more than 20 years later.

“This is, in theory, an attempt to evade government regulations,” CGU explains. “These facts are strong evidence of fraud, as they appear to reveal that there was no valid expression of consent on the part of the beneficiaries,” the governing body continued.

the other side

The big city Attempts to contact the person named in this article by email and phone did not result in a response until the last update. This space will remain open for future demonstrations.