What Argentina is facing historic occasion: To be a strategic pole of technology investment with global reach in artificial intelligence, supported by applications in agro-industrial bioeconomy, bioinformatics for health, energy and mining. The agri-industrial bioeconomy “cluster” will drive the entire value chain, including huge opportunities in finance, logistics, as well as blockchain and tokenization of actual agri-industrial assets.

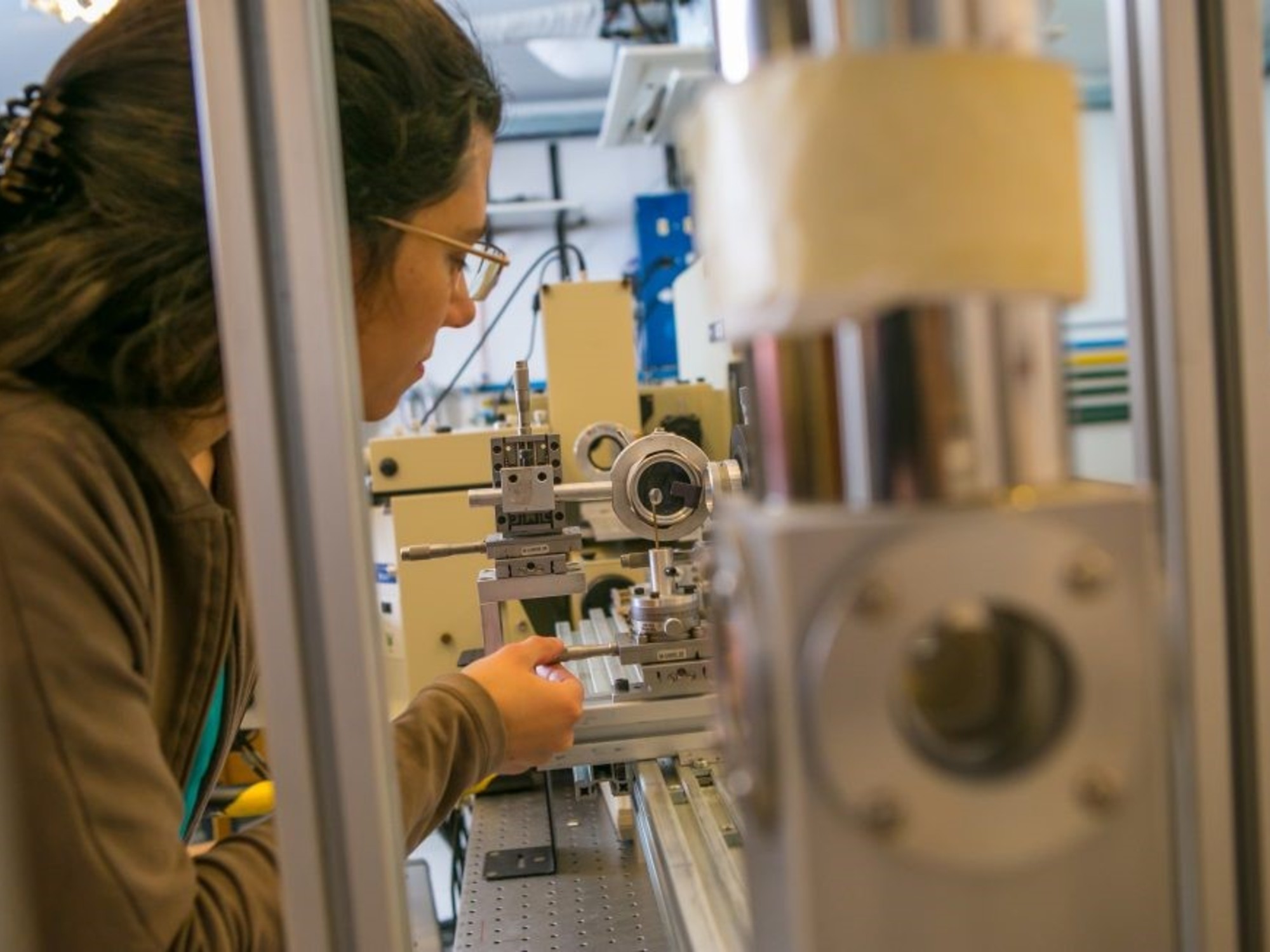

Inspired by the vision of the recently deceased Matt Travizzano, and now in synergy with the OpenAI-driven data center megaproject led by Emiliano Kargiman, the country has A science and technology base that allows us to compete in global niche markets. Venture capital has a significant opportunity to support the development of vertical applications related to trillions of ongoing global infrastructure investments. Institutions such as the Barceiro Institute in Bariloche, public universities such as UBA, La Plata, Córdoba, Santa Ferrosario, Mendoza and Tucumán, together with ITBA’s Artificial Intelligence program and the highly ambitious Universidad de San Andrés, are laying the foundations for an ecosystem that has the potential to gain a niche in the global market for disruptive innovations that require venture capital at an early stage of development.

The history of venture capital in Argentina began in 1998, when we launched Latin America’s first technology fund in collaboration with Hicks Muse at the height of the Internet revolution. I like entrepreneurs Vaclav Casares, Marcos Galperin, Roberto Souviron, Alec Oxenford, Martin Mendes They appeared as the prototype of the youth of that time. The Hicks Muse fund invested in some of them. Projects that later became regional aspirations: Mercado Libre, Despegar, Amtec (now Neoris). These were the times of e-commerce and “cloning” of global models adapted to Latin America. In the 2000s, the focus of my venture capital investments shifted to local innovation with an international perspective. Projects such as Grandata led by Matt Travisano, Kekron Biotech led by Hugo Menzella in the biotechnology field, Technisys led by Miguel Santos in the banking software field, and Sandbox in the video game field appeared and participated.

A new agenda begins for venture capital today In our country. From the agro-industrial bioeconomy to finance, logistics and value-added chains, Argentina can transform into a laboratory for applied innovations with local impact and global projections in sustainable food security. This topic is already fully integrated into the agenda of institutions such as Acrea Tech and Aapresid. Emerging funds such as Inventure (Santa Fe) and Panpastar (Cordoba) are also emerging in rural areas.

The road to a competitive and innovative Argentinaa is supported by the fusion of the agro-industrial bioeconomy and the knowledge economy. This binary relationship forms the basis of a sustainable development model, with productivity spillovers throughout the country. Integrating science, technology and natural resources around regional clusters of bioeconomy, energy, mining and advanced financial and logistics services will enable the country to become a protagonist of a new digital and sustainable economy. AdecoAgro and AgroToken are lighting an early path to integrating the country’s best productive assets with blockchain and tokenization technology. We feel that Bunge’s investment in AgroToken aims to enable Bunge to track and authenticate the 200 million tons of grain it trades annually. Certified traceability is a huge opportunity for Argentina.

we face the challenge of coming together Technology venture capital with development model It is supported by the country’s competitive natural resources.

Argentina’s talent can lead regional and global technological transformation as long as it can be aligned with intelligent capital. The big challenge is attracting new LPs (limited partners), the institutional investors who will fund venture capital funds. The industry is experiencing a global contraction, increasing the concentration of capital in a smaller number of funds. Reversing this trend requires strategic vision and faith in the country.

From the creation of Endeavor Argentina in 1998, which promoted entrepreneurial leadership, to the creation of ARCAP in 2008, which institutionalized the venture capital ecosystem, the country has taken steps towards a culture of innovation supported by innovative entrepreneurs. Today’s agenda also includes companies whose venture capital efforts align with their competitive strategies. But the challenge in 2027 is to transform that capability into a global technology company with productivity and ripple effects for the federal government. It can be said that it is necessary. A new generation of active policies in science and technology, It has clear ongoing tax and labor reforms to encourage productive investment, and a strong competitive market sentiment oriented towards global markets.

Macroeconomic policies are necessary but not sufficient. We also need a productive policy framework that makes investment in innovation highly profitable. The Large-Scale Investment Incentive (RIGI) could play an important role if applied creatively to the knowledge economy and facilitated the creation of a US$1 billion technology “fund of funds” that could repatriate Argentine private capital currently abroad. If Argentines invest, other countries will invest without limit. Fund of funds aims to become an anchor investor With science and technology-based projects originating from public and private universities and around 10 venture capital funds channeled to CONICET, securing funding for domestic talent along the agro-industrial bioeconomy, energy and mining clusters, the country appears to be gathering a critical mass of public-private strategic vision relevant to strengthening its international competitiveness in this area.

The purpose is clear. It’s about creating a critical mass of technological ventures that allow us to retain talent rather than export it. “We have to make investing in Argentina a business, not just Argentines who succeed abroad,” an investor told me at a recent ARCAP conference.

Argentina does not yet know how to articulate its entry into new international long-term financial flows. Connections with the Gulf States, especially Saudi Arabia’s sovereign wealth fund, which manages more than $800 billion, could play a decisive role. Its capital seeks sustainable and scalable projects that have real impact. Brazil is already taking advantage of that opportunity. Argentina still has time.

Undoubtedly, the positive future for venture capital in Argentina depends on our ability to align purpose and profitability. Create conditions for Argentine private capital to love and trust this country.