Revenues from oil royalties could increase by around R$4 billion from 2026 due to the revision of the reference price per barrel used to calculate these transfers, as provided for in the MP for the electricity sector. The money would shore up federal cash flow and state and local production funds in the middle of an election year.

Royalties are financial compensation paid by companies that extract oil. In Brazil, in addition to reducing the environmental impact of exploration, it is distributed among federal, state, and local governments to compensate society for the use of public assets and to finance investments in areas such as education and health.

Of the total amount, 1.5 billion reais of net revenue will go to the federation and a further 1 billion reais to producing states and municipalities. This calculation already discounts the impact of reduced dividend collection from companies due to changes in oil companies’ profits, IRPJ (corporate income tax) and CSLL (social contribution to net profit).

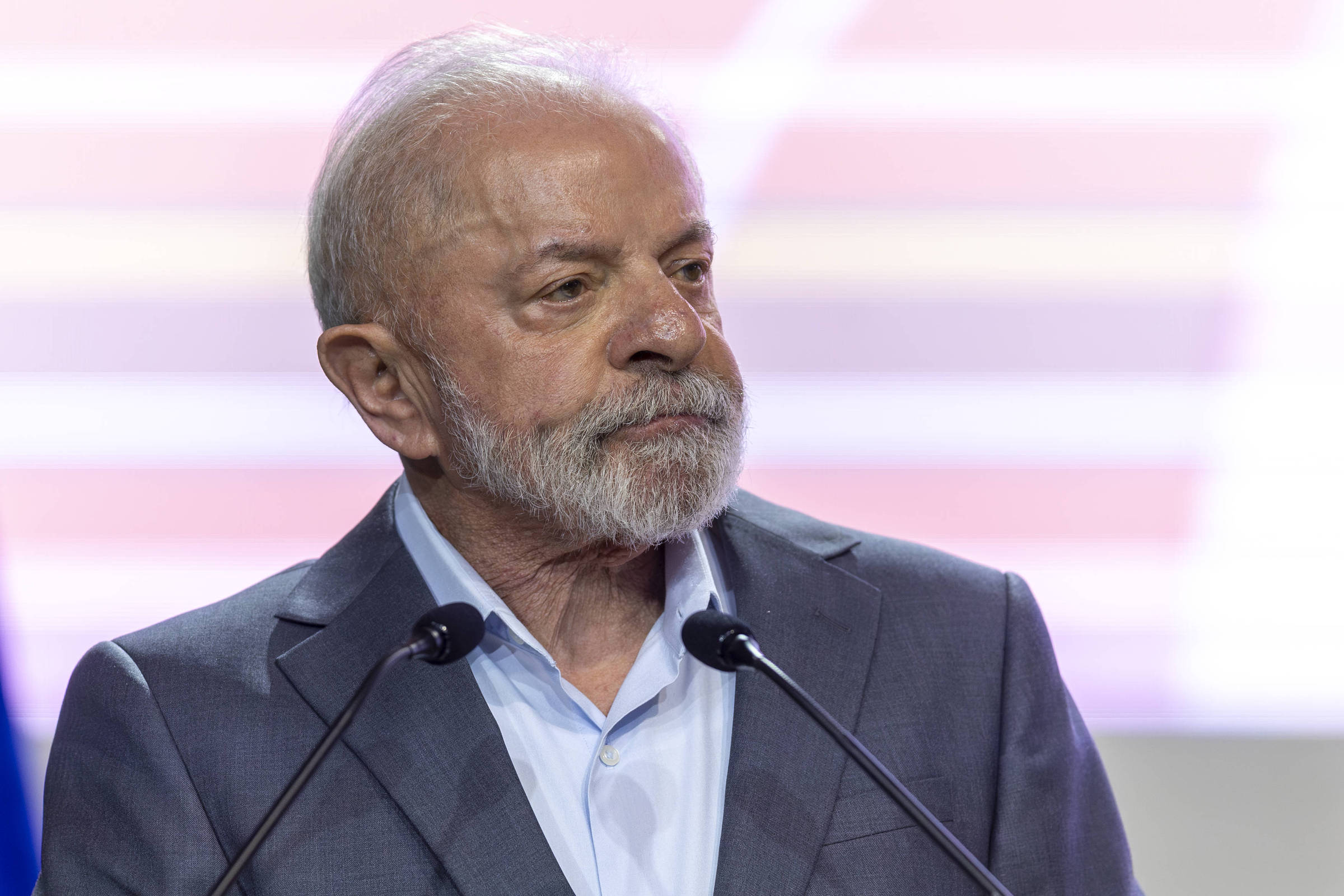

The calculation obtained by sheet These were drawn up by government technologists to support President Luiz Inácio Lula da Silva’s (PT) decision on whether to veto the changes contained in the MP (temporary measures) for the electricity sector. The new law was approved by Congress on October 30th and is awaiting presidential approval.

There is pressure to veto this change, with the support of national refineries and the participation of Senator Eduardo Braga Rapporteur (MDB-AM). The issue caused division within the government, with both sides supporting the president with figures on the impact of the measure. Lula has not yet decided whether to veto the changes.

On one side of the debate are presidential aides who defend reviews aimed at improving revenue collection to strengthen public accounts. Meanwhile, some groups want to protect Petrobras’ investment plans.

Petrobras and other oil companies are pushing for a veto, but state-run refineries want to keep the approved documents intact. We contacted the company and did not receive a response until the report was published.

According to the document approved by parliament, the rules for calculating oil royalties will be based on average prices published by internationally recognized price information agencies. If this information does not exist, the law requires that the methodology defined by law or executive order be used.

Currently, the reference price is calculated monthly by ANP (National Petroleum Agency). There is some kind of table in place that actually results in the value of the barrel being below the market price.

PPSA (Presal Petroleo SA) sells crude oil 4% more expensive than the price of each barrel claimed by ANP, according to data supporting technical studies showing an increase in revenue of R$4 billion. The company works with the Ministry of Mines and Energy to manage oil and gas production sharing agreements in the pre-salt area.

The main purchaser of PPSA oil is Petrobras. One government engineer involved in the study said: sheetsaid on condition of anonymity that the estimate of 4 billion reais is conservative because there are only three oil producing fields in Brazil for which international organizations have published prices so far: Melo, Buzios and Tupi.

These three sectors account for almost 60% of domestic production. Other simulations showed values between 9 billion and 10 billion reais. For proponents of the change, the way royalties are charged is wrong and the amount Petrobras pays in excess amounts to 3% of the oil company’s investment and does not jeopardize its financial health.

Veto supporters have told the president that the fiscal argument is biased because the changes would affect Petrobras’ operating cash flow and the transfer of dividends and taxes to the federal government.

Petrobras’ investment plan for 2026 to 2030 is expected to be announced this month. On the eve of the announcement, it was assessed that changes to royalty payment terms and so-called special participation (special rewards for large volumes) would undermine the financial viability of the company’s investments. The company is at a stage where it is preparing to survive the scenario of a decline in oil prices.

With oil prices falling, this measure will have an economic impact on production in some oil fields. Lula’s aides cited Sergipe Aguas Profundas, a Petrobras project to explore for oil and gas off the coast of Sergipe, as one of the investments affected.

Other projects at risk of being compromised include revitalization projects in old areas such as Marlim and Albacora fields.

Government officials critical of the change in calculation also argue that the additional revenue would be small compared to the increase in domestic natural gas supplies. Furthermore, the state that would benefit most from the additional revenue would be Rio de Janeiro, which is ruled by the opposition.

In a memo, RefinaBrasil, an association representing about 20% of the domestic oil derivatives market, supports the need for sanctions as a means to correct persistent regulatory distortions in ANP reference prices.

According to the group, the measure aims to re-establish compliance with the Petroleum Law, which imposes market prices as a mandatory parameter for the purpose of calculating government shares.

According to the corporate entity’s calculations, the reference prices used by ANP are systematically lower than international prices, resulting in losses of R$83 billion to R$111 billion over 10 years.