Negotiations between Casa Rosada and the governor may have predictable objectives, such as supporting public reforms in Congress or funding state public works projects. However, in other cases, unexpected. For example, in rural areas Fiscal transparency regimeIt is known that there is an obligation to clarify the tax burden of each product on the consumer’s receipt.

your application It may affect the purchases of all Argentines. he Fiscal transparency regime In public offices, it has been described as a tool in the “cultural war” against taxes. It is not actually deleted. “We’re trying to make it clear to consumers how the tax burden affects everything. It means being responsible,” said one promoter.

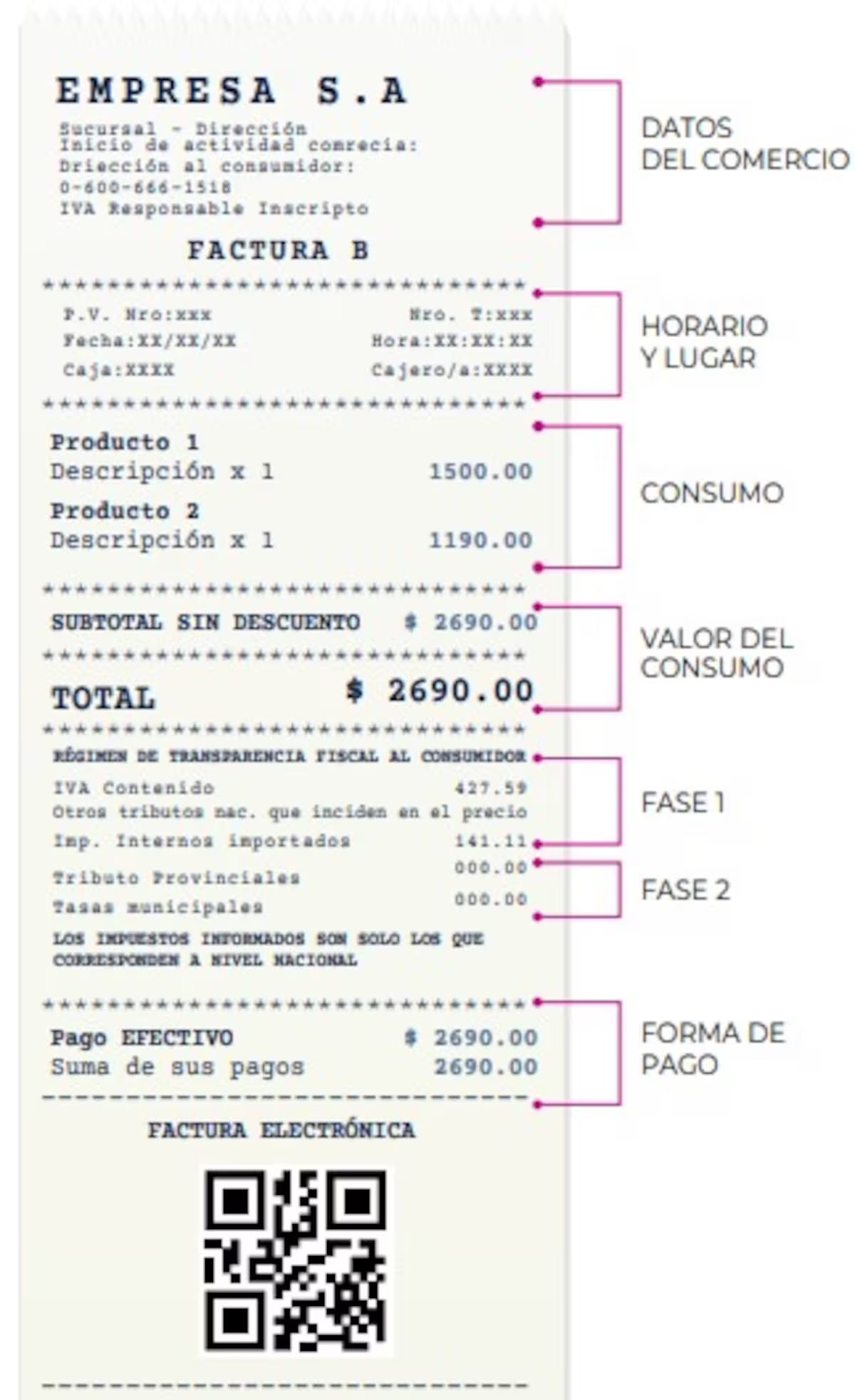

This concept was approved in 2024 during the base law debate. After more than a year, I feel like I’m finally “halfway through.” Introducing the famous “tax-excluded price”attempts to explain how much consumers pay for the products they purchase and the corresponding taxes. This was included in the document approved by Congress. Its implementation is limited.

it started by national tax. “Every entity engaged in sales, recruitment or provision of services to final consumers must, in publishing the price of their respective goods or services, indicate the final amount that must be paid by the final consumer and, furthermore, the net amount, excluding Value Added Tax (VAT) and other indirect national taxes affecting the price,” the law states. That means no state or city taxes are included.

For them, the regulations provide: “The State and the Municipality of Buenos Aires are required to establish their own regulations so that end consumers are aware of the accrual of gross income tax and the respective local taxes that affect the formation of prices for goods, places and the provision of services.” It was an invitation. Few accepted it.

According to a survey by an organization called logiconly two states adhered to the project’s predecessor, the Fiscal Transparency Regime. Chubut and Mendoza. The map shows in red jurisdictions that have not begun efforts to deepen “price-exclusive” tickets according to the standards, and in yellow those where efforts are “in progress.” This last group includes Salta, Córdoba, Entre Ríos, Buenos Aires Autonomous City.

But beyond these jurisdictions, some officials have vowed to take the initiative further and try to introduce it in their next round of talks with governors. In which one? These were started in the second half of Javier Millay’s term. Despite the dialogue strategy, official sources said: “Plan B” is also available.especially designed for people who don’t expect their ideas to be well received. “Tools already exist to see how gross income impacts purchases,” the person said.

As such, he indicated that a draft resolution was being prepared calling for: Create a “calculating agent” consisting of representatives of ARCA, officials of the Ministry of Economy, Chambers of Commerce and, in some cases, representatives of the states.. As they explained, the device has the ability to perform a “retail transaction coefficient” that determines the incidence of all taxes on the price of things in a standardized basket.

As they explained, standardized baskets will target businesses close to everyday life. It specified that the focus would be on supermarkets, electronics stores, and clothing stores.

Before we talk about this “computation agent”, let’s say that the organization logic, We have begun contacting local governments as a precursor to a fiscal transparency system. He sent a letter asking whether companies are willing to implement this initiative and whether companies that begin applying it voluntarily could be subject to sanctions.

IMisiones answered them: “There will be no retaliation in your jurisdiction if a company makes the report you cited before the rule is issued.”

The state of Entre Ríos also responded to advocates of fiscal transparency. According to the letter signed by the governor, “there are no provisions that apply sanctions to businesses or taxpayers who voluntarily declare local taxes.” Rogelio Frigerio.

of buenos aires city “We will not require a summary investigation to assess the typicality of the conduct in order to apply final sanctions,” he said, referring to the companies that have begun disclosing the inclusion of Buenos Aires taxes on airline tickets.

Formal negotiations on the next level of the fiscal transparency regime will begin soon. Its promoters believe that in the short term, Twelve of the 24 jurisdictions would be “suitable targets.”

According to statistics from the Logica organization, the share of taxes in food prices can reach 42%. 50% for clothing and 53% for cars. They argue that transparency could be the first step towards subsequent reductions. Or, ultimately, giving consumers more tools when deciding where to buy.