Ray Dalio, one of Wall Street’s most influential investors, believes there is no chance of a political agreement that can avert a “heart attack” on U.S. public accounts in the coming years. The American billionaire recently published How Countries Fail (Intrinsic), in which he describes the mechanisms by which accelerating debt issuance often brings seemingly solid economies to ruin.

The author discussed the paper with Column via email, but declined to answer questions about Brazil and President Trump’s tariffs. Mr. Dalio, whose fortune is estimated by Forbes at $15.4 billion, just sold his last stake in Bridgewater Associates, which he founded in 1975 and became one of the world’s largest hedge funds. Now, he wants to spend more time writing and creating “very cheap” courses to spread his investment techniques.

— and I, like Jacques Cousteau, am excited to explore the ocean and share it through media through the OceanX initiative I founded with my son Marc — he concluded.

Why is there a real risk that the US will go bankrupt? Wouldn’t the dollar’s “extraordinary privileges” protect them?

That’s because of the way the debt cycle works. Debt crises are always resolved by a combination of default and money creation, and this is exactly what happened with the depreciation of other reserve currencies such as the pound and the guilder (the former currency of the Netherlands). This is what happens when fiat currencies no longer serve as an effective store of value. For me, watching current events is like watching a movie I’ve seen many times before. The US government spends $7 trillion a year and collects $5 trillion. Debt is 6 times your income. The government has been unable to cut spending because much of it is mandatory, and debt service (roughly $1 trillion, half the deficit) is weighing down the rest. The deficit will likely require the issuance of a large amount of government debt in excess of demand. This will lead to a public debt crisis within three to five years.

The ideal is to reduce the budget deficit to around 3% of GDP (this year’s forecast is 5.9%). The economy is expected to grow at around 3% per year, which should be enough to stabilize the debt/income ratio. But this 3% deficit is only possible by adjusting the three variables that determine it: spending, taxes, and debt interest.

What impact will President Trump’s policies have on debt growth?

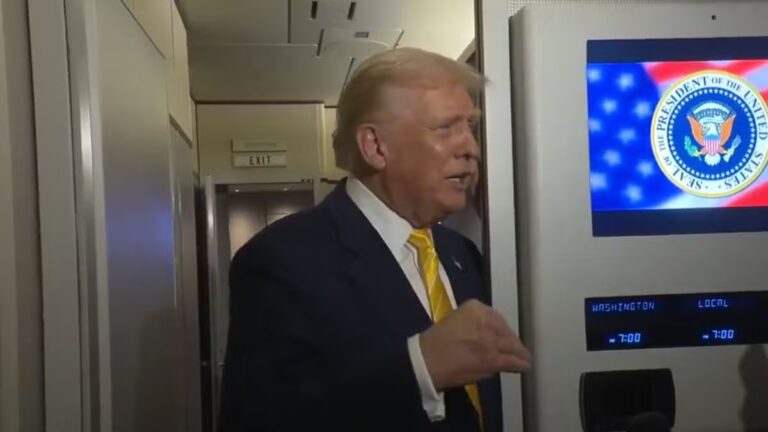

This problem is not caused by a single government. But the so-called Big Beautiful Act, the massive budget plan approved by President Trump, could increase the debt from $36 trillion to $55 trillion. Before that happens, there will be a debt crisis and a currency crisis, which I call a “heart attack.” Like plaque in an artery, interest payments impede remaining spending, leading to system paralysis similar to economic collapse. Presumably, this would cause the government to print more money, reducing its value and making the national debt less desirable.

And what impact will the US president’s authoritarian tendencies have on the economy?

Rising inequality typically leads to the strengthening of populism on the right and left. As democracy weakens, a large portion of the population begins to desire a strong leader who can “set the system in place.” We see these forces at work in the United States today. The deployment of the National Guard to cities hit by conflagrations, attempts by both parties to change voting rules, and moves to tighten the president’s control over the central bank. We also live in a time of great conflict between nations. The current phase, which I call the Great Debt Cycle, is very similar to the period from 1928 to 1938.

But are you optimistic that your proposal will be adopted?

Republicans and Democrats know that only a bipartisan combination of revenue increases and spending cuts can sustainably solve debt and deficit problems. However, as politics has become extremely absolutist, he feels that he cannot proceed down that path because he will be punished by voters. So I’m not optimistic. The best-case scenario is that some agreement is reached after the 2026 parliamentary elections, but nothing changes before then.

You are often criticized for predicting crises. Are your alerts treated with the seriousness you think is appropriate?

I spoke to many politicians of various persuasions, including most of the former Treasury secretaries and former Fed chairs who supported this book. Leaders understand its gravity, but the question is whether there is the political will to deal with it in a polarized democracy.