Europe is experiencing a new economic phase in which the financial sector is at the center of transformation. Interest rates, regulatory pressures, and environmental shifts paint a picture of an environment that is both opportunity-filled and challenging. The banking industry faces a decade … This is a critical issue that requires redefining operating models, integrating sustainability into business, and leveraging technology to strengthen customer trust. Spain has an advantage thanks to its solvency, level of digitalization and system maturity, but the challenges at stake require speed and long-term vision.

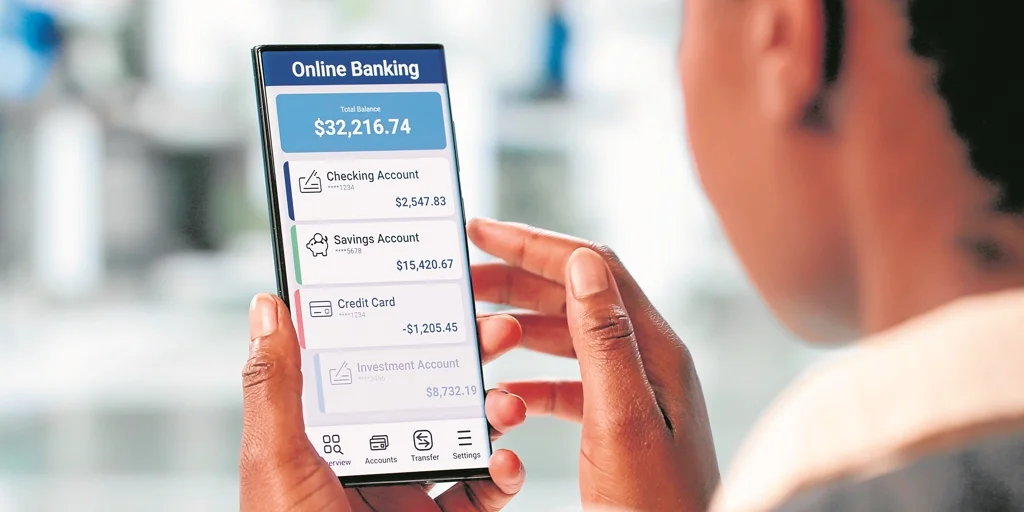

Alejandra Kindelan, President of the Spanish Banking Association (AEB), asserted that digitalization is already a driver of innovation and progress, placing Spanish banking among the leaders in Europe. Over the past decade, businesses have doubled their investment in technology and security, and more than three out of four people use digital channels every day. While cases like Bism demonstrate the financial system’s ability to innovate and collaborate, Kindelan warns of the obvious risks of “maintaining competitiveness without losing the trust of banks, their greatest asset: their customers.” Following this leadership, the sector must gain agility to adapt to an ever-changing environment.

Francisco Joaquín Cortés, Professor at Alfonso University Technologies such as blockchain, AI, and big data are changing customer relationships and risk management. The emergence of fintechs and big technology companies has opened up an ecosystem where regulation, cybersecurity and inclusion are integrated as pillars of a sustainable and competitive transition. Modernization affects not only the internal structure of banks, but also the way they compete on a global scale.

Óscar Bagno, business and technology strategist at T-Systems Iberia, says Spain faces this stage with an advantage “in digitalization and cybersecurity, although global competition is accelerating.” Neobanks and fintechs are redefining the user experience in the following ways: Super app and instant servicethe immediacy of payment and the contextual value of information become new service metrics. Traditional companies, he argues, “need to reinvent themselves to remain relevant. The difference between competitors and leaders will depend on their ability to predict and leverage the value of data in real time.”

The lines between finance, technology, and digital services are blurring. In this hybrid space, collaboration between banks, start-ups and technology providers is as important a strategic element as solvency and profitability.

evolution of culture

On the regulatory side, generative AI, tokenization, and European standards (Dora and Mica) are redefining financial architecture. Laura Baselga, professor of finance at Deusto Business School, explains:Dora strengthens cyber resilience and Mica provides legal security for crypto assets». This change is not only technological, but also requires a cultural evolution that prepares entities to work in an open and collaborative environment. In these areas, transparency and user protection are the true foundations of trust.

Mario Aguilar, vice president of banking and insurance at Capgemini Spain, sees a major shift in the adoption of technology. Digitization is not a destination, he says. Continuous processes throughout the value chain. Cloud expansion, instant payments, or advanced automation are driving more efficient and interconnected banking. Additionally, “modular architectures based on open APIs enable the smooth creation of new services, giving small businesses tools that were previously reserved for large enterprises.” Advances in technology aren’t just about lowering costs. It frees up resources for closer, more personalized attention, which is key to building loyalty among increasingly demanding digital customers.

This digital revolution will also redefine the connection between finance and society. Daniel Fuster López, partner for financial services at NTT Data, believes the future of the sector lies in being sustainable and focused on people. Financial education and digital inclusion are pillars of a balanced economy. He emphasizes that technology should empower customers, not alienate them, and its value lies in simplifying processes and bringing banking closer to the people. He added that social purpose is “as important today as profitability, and the next wave of innovation will be measured by its ability to reduce disparities in knowledge, trust, and participation.”

“Europe needs to adapt its regulations to the pace of innovation or risks losing relevance,” warns Mariano Lasarte, partner in finance at KPMG. excessive bureaucracy“He argues that it will be less agile than other markets.” A framework with progress that follows simple, proportional rules would restore dynamism to the financial system. For him, “strengthening cooperation between institutions and regulators is key to achieving a balance between control and experimentation without slowing the development of this field.”

Sustainability is established as a true driver of value. Pablo Bagno, also a financial services partner at KPMG, believes that “by integrating environmental, social and governance criteria, we can anticipate risks and direct funds to projects that are consistent with the ecological transition.” This vision will transform the relationship between banks, investors and customers, and “put trust and long-term at the heart of our strategy. Turning sustainability into a real means of growth will differentiate the companies that evolve from those that are left behind.”

In the field of culture, IEB’s Miguel Ángel Barrio believes that technological transformation can only reach its true potential if it is accompanied by it. change of mind. It is not enough to simply modernize systems or make them more resilient. It requires leadership, training, and a shared vision. Beyond tools, what matters are people and their ability to adapt innovation to each organization’s values and objectives. It also highlights the need to protect systems from fraud and digital incidents, a key aspect of the new Open Banking.

Cortés, of Alfonso El Sabio University, agrees that the challenges to the financial system are “no longer temporary, but structural.” The speed of change requires us to “rethink risk management, decision-making, and talent development.” Continuous learning and flexibility will mark the difference between companies that lead in the next decade and those that are left behind. Internationally, “competition is intensifying.” Bagno points out that digitalization has erased borders and users are comparing banking with other digital services. KPMG’s Lasarte also warned that “Europe cannot afford to proceed at a slow pace determined by bureaucracy.” They agree that there is an urgent need to integrate a more agile European financial market that can attract investment and keep innovation at the pace of technological capabilities.

Client relationships have become a real area of competitive advantage. Capgemini sums it up bluntly: “Anticipating needs and providing fluid, safe care makes a difference.” Aguilar explains that trust is built through everyday experiences such as secure payments, simple processes, and transparent communication, while Bagno emphasizes the importance of: Be empathetic and consistent in all interactions. Innovating without losing the human side is the essence of the future of banking for both.

NTT Data’s Faster agrees that technology should bring banking closer to people rather than further away. Financial education and digital inclusion are pillars of a more participatory economy, he argues. Success in this sector will not depend on technological sophistication, but on the ability to reduce access gaps and ensure that no one is left behind in the new economy.

Pillars of stability against channel changes

The insurance industry is entering a decisive phase characterized by digitalisation, climate change and the evolution of savings. At the last Insurance Conference, organized by Deloitte, ABC and Mapfre, UNESCO President Milenc del Valle Schaan identified insurance as a key pillar of European economic stability. He emphasized that insurance companies manage over 15 trillion euros in assets and play a key role in directing investments towards the green transition and economic resilience.

Mr Del Valle defended simplifying Europe’s regulatory framework to free up capital and encourage long-term investment, especially in sustainable projects. He also advocated the need to “strengthen financial education and restart supplementary pension savings through measures such as automatic enrollment and pan-European products”. On climate issues, he highlighted the strength of Spain’s system, which is based on cooperation between private insurers and insurance coverage consortia, allowing an agile response to natural phenomena. However, he warned of “insurance disparities in housing and rural areas and the importance of promoting prevention and social awareness.” On the technical level, the UNESCO President pointed out that digitalization must take place at the technical level. Tools to strengthen sector resilienceAs long as it is managed in an ethical and guaranteed manner. He emphasized that insurance is essentially a data-based industry and its ability to innovate must be accompanied by responsibility and trust.

Professor Jaime Romano from EAE Business School agrees that digital transformation and sustainability are redefining the future of the sector. He believes AI, data analytics and coverage personalization will drive “new intelligent insurance models that can adapt to customer needs in real time.” Romano also identifies talent, collaboration with “insurtechs” and ethical information management as pillars that will ensure competitiveness and trust over the next decade.