With access to housing becoming one of the main social issues in Spain, the pressure on the rental market is increasing. Lack of supply, rising prices, and economic uncertainty are making it difficult for many families to find apartments, while owners are seeking greater security.

In this context, recent proposals for multi-million dollar fines for companies in this sector Allegations of abusive behavior towards tenants have brought renewed attention to the obligations of each party. Within the legal limits set by the Urban Lease Act (LAU). From SEAG they reveal the eternal debate.

What costs can be passed on to the tenant?

In accordance with the Urban Rental Act (LAU) and consumer protection regulations, Brokerage fees, contract insurance, management services, etc. cannot be transferred. However, unless the service is explicitly requested or provides a direct benefit, it will be provided to the tenant. Otherwise, these costs correspond to the owner or intermediary company.

In fact, one of the most common questions focuses on: Who must pay insurance for rent arrears? The current LAU allows landlords to request additional guarantees such as bank guarantees and insurance, but does not specify who has to pay them. However, based on SEAG’s experience and various legal studies, we believe that clauses requiring tenants to pay for this type of insurance are invalid because they exclusively benefit the landlord and violate the principle of contractual proportionality.

in fact, A court in Madrid has already declared this type of clause invalid.considers the obligation on the tenant to pay enough insurance to protect the owner to be abusive.

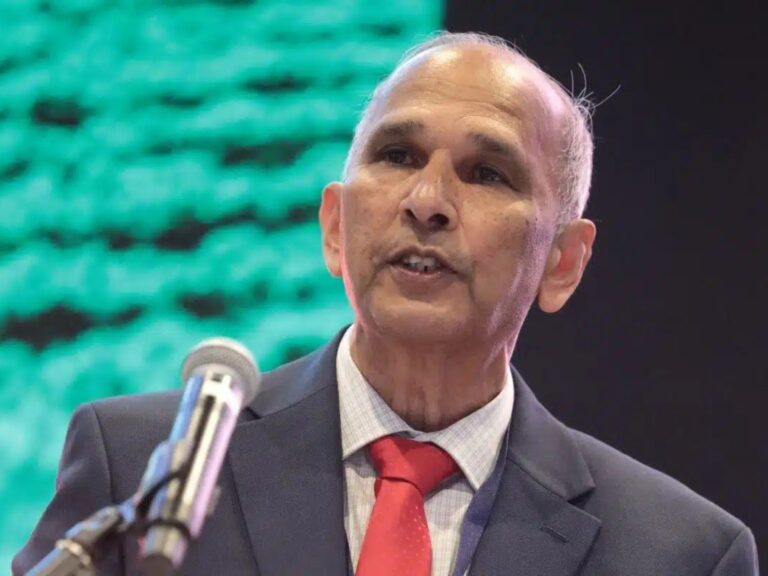

“There needs to be transparency and balance in the rental market. Owners need to understand what they are signing up for, and tenants need to know what rights they have. At SEAG, we work to ensure that both parties are protected and that unresponsive costs are not passed on to tenants.” Pedro Breton, CEO of SEAG, explains:

However, SEAG has always recommended that landlords pay these deposits, even if regulations allow them to require deposits from tenants. ”If a tenant is unable to pay the rent, it is impossible to cover the insurance premiums as well. Or its renewal. In that case, the owner would be left uncompensated, which is exactly what we want to avoid with our warranty model,” the company explains.